Vancouver is a beautiful city that consistently ranked as the top city in the world in terms of quality of living. Many foreign national and foreign corporation wanted to buy real estate or set up business in Vancouver. But it is hard to find reliable tax information applicable to foreigners. Even worse, many of the information is outdated or irrelevant.

Working as a Vancouver Realtor in the last ten years, I have helped many foreigners purchased and sold properties in Vancouver. So today, I will use this blog to share my experiences working with foreigners buying real estate in Vancouver.

Table of Contents

In addition to Goods and Service Tax and Property Transfer Tax, a foreigner or foreign corporation needs to pay additional Property Transfer Tax in British Columbia. Many people often called this extra Property Transfer Tax the “Foreign Buyers Tax”, “BC Foreign Buyer Tax”, or “Vancouver Foreign Buyer Tax.”

BC Foreign Buyers Tax is an additional Property Transfer Tax, introduced by the British Columbia provincial government on August 2, 2016, to help curb the rising Vancouver Housing Market. Click here for more BC Foreign Buyer Tax Details.

Please note that Toronto, Ontario also has its own Foreign Buyers Tax. Click here if you are looking for more information about Foreign Buyers Tax in Toronto, Ontario.

The Vancouver housing crisis dates back to the late 1970s. Many factors contributed to the rise in the Vancouver Housing Market. The continual increase in the Vancouver House Prices eventually made Vancouver housing the third most unaffordable city in 2016. Finally, on August 2, 2016, the BC government introduced Bill 28, the Miscellaneous Statutes (Housing Priority Initiatives) Amendment Act.

The Act consists of four parts: (1) Vacancy Tax (2) Foreign Buyers Tax (3) Amendments to the Real Estate Services Act (4) Creating a new housing initiative.

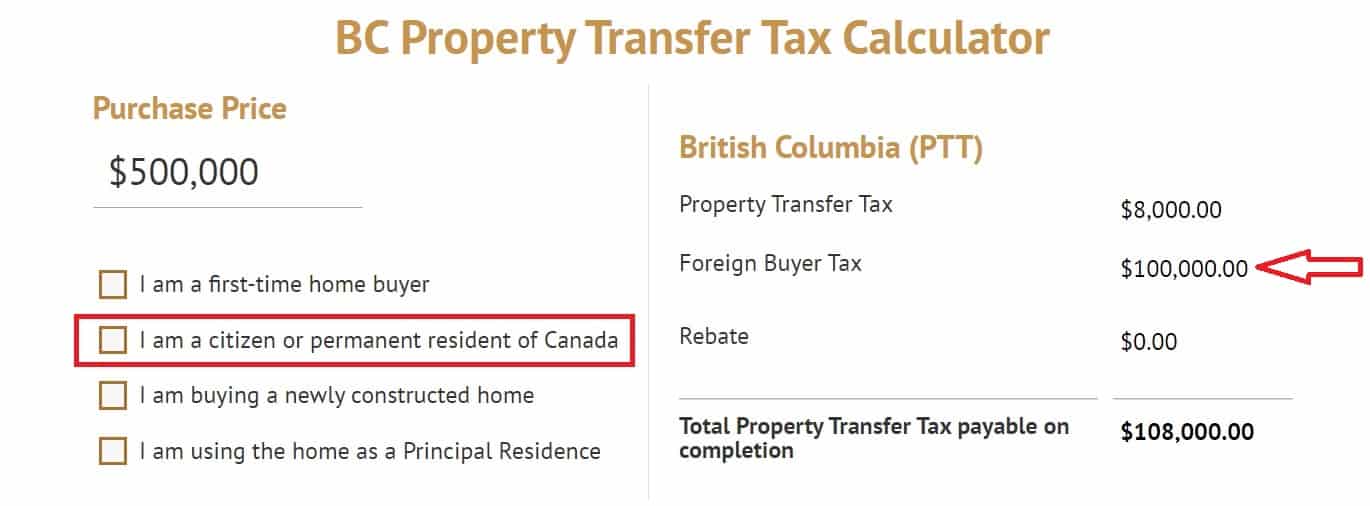

If you are a foreign buyer looking to buy a home in BC, this calculator can help you figure out how much BC foreign buyer tax you need to pay. To find out the foreign buyer tax, just enter the fair market value of the home you are buying in BC and make sure that the “I am a citizen or permanent resident of Canada” is NOT selected.

Foreign nationals may be exempted from the additional Property Transfer Tax if he or she is (1) exempt from property transfer tax (2) a confirmed BC Provincial Nominee (3) acquiring a property on behalf of Canadian-controlled limited partnership.

See the below map to learn where the Foreign Buyer Tax applies.

According to the BC government, “foreign national” means a person who is not a Canadian citizen or permanent resident of Canada.

British Columbian government defines “foreign corporation” as a corporation that is one of the following: (1) Not incorporated in Canada, or (2) Is incorporated in Canada but is controlled directly or indirectly by one or more foreign entities.

According to the Province of British Columbia, a taxable trust is a foreign national or foreign corporation holding title in trust for beneficiaries. A taxable trustee can also be a Canadian citizen or permanent resident, if a beneficiary of the trust is a foreign national or foreign corporation and that beneficiary holds a beneficial interest in residential property held by the trust immediately after registration of the transfer with the Land Title Office.

All the Gulf Islands, Ballingall Islets, Beaver Point Island, Brethour Island, Central Saanich, Charles Island, Chatam, Coal Island, Colwood, Comet Island, D’Arcy Island, Discovery, Dock sland, Domville Island, East Sooke, Esquimalt, Forrest Island, Fulford Harbour Island, Galiano Island, Ganges Island, Georgeson Island, Gooch Island, Goudge Island, Great Chain Islands, Griffin, Hall Island, Highlands, Jackscrew Island, James Island, Jordan River, Julia Island, Kerr Island, Knapp Island, Langford, Leechtown, Lizard Island, Long Harbour Island, Malahat (on the western shore of Saanich Inlet), Mandarte Island, Mayne Island, Metchosin, Moresby Island, Mowgli Island, Musgrave Landing Island, North & South Pender Island, North Saanich, Norway Island, Oak Bay, Otter Point, Parker Island, Piers Island, Port Renfrew, Portland Island, Provost Island, Pym Island, Reay Island, Saanich, Samuel Island, Saturna Island, Secretary Island, Sheep Island, Shirley, Sidney, Sooke, Sphinx Island, Vesuvius Bay Island, Victoria, View Royal, Wallace Island, Willis Point, Wise Island.

Abbotsford, Boston Bar, Bridal Falls, Canyon Alpine, Chilliwack, Choate, Columbia Valley, Cultus Lake, Deroche, Dewdney, Dogwood Valley, Emory Creek, Harrison Hot Springs, Harrison Mills, Hatzic Island, Hatzic Prairie, Hemlock Valley, Hope, Kent, Laidlaw, Lake Errock, Lindell Beach, McConnell Creek, Mission, Nicomen Island, North Bend, Othello, Popkum, Ruby Creek, Spuzzum, Sunshine Valley, Yale.

Anmore, Belcarra, Bowen Island, Burnaby, Coquitlam, Delta, Langley (City), Langley (District Municipality), Large area to the north of the North Shore, Lions Bay, Maple Ridge, Metro Vancouver Electoral Area A (Barnston Island), Metro Vancouver Electoral Area A (Bowyer Island), Metro Vancouver Electoral Area A (Buntzen Bay), Metro Vancouver Electoral Area A (Granite Falls), Metro Vancouver Electoral Area A (Passage Island), Metro Vancouver Electoral Area A (Strachan Creek), New Westminster, North Vancouver (City), North Vancouver (District Municipality), Northern portion of Indian Arm, Pitt Meadows, Port Coquitlam, Port Moody, Richmond, Some subdivisions between Horseshoe Bay and the Village of Lions Bay, Surrey, University of British Columbia (UBC), Vancouver, West side of Pitt Lake, West Vancouver, White Rock.

Beau Park, Blue Grouse, Brent Road, Caesars Landing, Cinnabar Estates, CORD East Electoral Area I, Crystal Mountain, Estamont, Ewings Landing, Fintry Delta, Jenny Creek, Kelowna, Killiney Beach, La Casa Resort, Lake Country, Lake Okanagan Resort, Muirallen Estates, Nahun, Peachland, Pine Point, Secret Cove, Shelters Cove, Traders Cove, Trepanier Bench, Upper Fintry, Valley of the Sun, Wainman Cove, West Kelowna, Westshores Estates, Wilson Landing.

Arrowsmith, Benson, Bowser, Cameron Lake, Cassidy, Cathedral Grove, Cedar, Coombs, Dashwood, DeCourcy Island, Deep Bay, East-Wellington, Englishman River, Errington, Extension, French Creek, Gabriola Island, Hilliers, Horne Lake, Lantzville, Meadowood, Mudge Island, Nanaimo RD Electoral Area E (Nanoose Bay), Nanaimo, Parksville, Pleasant Valley, Qualicum Bay, Qualicum Beach, Shaw Hill, South Wellington, Spider Lake, Whiskey Creek, Yellowpoint.

If you have any other questions about Foreign Buyers Tax or other Real Estate Tax questions, please contact me.

Sam Huang PREC

H & S Real Estate Group

Real Estate Coal Harbour

RE/MAX Select Properties

Address: 5487 West Boulevard, Vancouver BC V6M 3W5, Canada

Phone: 778-991-0649

WeChat: ubchomes

QQ: 2870029106

Email: Contact Me