Demystifying the BC Realtor Commission Conversation

Selling your home or condo is a monumental decision, filled with excitement, anticipation, and… a touch of confusion, especially regarding realtor commissions. Let’s face it: navigating the world of real estate fees can feel like deciphering a secret code. Many homeowners are scratching their heads, wondering, “How much will this cost me?” You’re not alone. Understanding realtor commissions is a crucial piece of the puzzle. Without it, you could be left with unexpected expenses and a less-than-ideal experience.

Many sellers rely on rumours or outdated information when it comes to commission. They might worry about hidden fees, unclear percentages, or feeling in the dark about the whole process. This lack of clarity can lead to anxiety, budget miscalculations, and even resentment towards the realtors involved. You might be asking yourself: What’s the standard rate? Is it negotiable? How does it all work? Without clear answers, you could leave money on the table or face financial surprises. Imagine how easy selling your home would be with a straightforward understanding of realtor fees.

That’s precisely why we’ve created this comprehensive guide to demystify realtor commissions in BC. We’ll break down everything you need to know, from the basic definition of realtor fees to how they’re calculated, and even touch on specifics for the Vancouver market and RE/MAX agents. But the best part? We’re introducing our handy BC Realtor Fee Calculator! This powerful tool will allow you to quickly and easily estimate your commission costs, giving you the clarity and control you deserve. With this calculator, you can confidently plan your budget and make informed decisions every step of the way. No more guessing or surprises – just clear, concise information at your fingertips. Let’s dive in and take the mystery out of realtor commission!

What is the Realtor Commission in BC?

Simply put, the realtor commission in BC is the fee paid to real estate agents for their services in facilitating a property transaction. The commission is typically a percentage of the property’s sale price in real estate. Think of it as the cost of doing business when buying or selling a home. It’s the compensation realtors receive for guiding you through the complex process, from listing your property to negotiating offers and closing the deal.

While it might seem like a straightforward concept, there are some nuances. In BC, it’s customary for the seller to pay the commission, which is then split between the seller’s agent (also known as the listing agent) and the buyer’s agent. This means that even though both agents are involved in the transaction, the funds come from the sale proceeds. Here’s an important takeaway: as a seller, you’re responsible for both ends of the commission. It’s a crucial detail to remember as you navigate the selling process!

Because real estate is a competitive industry, there’s no set “standard” commission rate. While some real estate associations used to set fixed rates, competition laws now prohibit this. In BC, commission rates are negotiable and can vary depending on several factors, including the property’s location, the services the agent offers, and the overall market conditions. As a general guideline, you might see commission structures ranging from around 3% to 4% on the first portion of the sale price (for example, the first $100,000) and then a lower percentage (from 1% to 2%) on the remaining balance.

However, these are just examples, and the specific rate is something you’ll discuss and agree upon with your realtor. Don’t hesitate to ask your realtor about their commission structure and how it applies to your situation.

Addressing some common questions:

-

- What are real estate fees in BC? Real estate fees and realtor commissions are essentially the same thing. They represent the payment to the real estate agents involved in the transaction.

- What is the realtor commission for selling a house in BC, and how does it work? Realtors in BC typically charge a commission, a percentage of the home’s final sale price. This percentage is not fixed and is negotiable between the seller and the realtor. The seller is the one who typically pays this commission, and it is then split between the real estate agents representing both the seller and the buyer.

- What is the realtor commission in BC? It is the fee paid to realtors. However, it’s essential to understand that a realtor’s commission is not a fixed amount. It can vary from realtor to realtor and from brokerage to brokerage. While there are general market trends, individual realtors and brokerages set their commission rates, which are often negotiable.

- What percentage do realtors take in BC? The rate can vary, but it’s often structured with a higher percentage on the initial portion of the sale price and a lower percentage on the remaining amount. This is negotiable between the seller and the realtor.

How is the Realtor Commission Calculated in BC?

Unlocking the Commission Calculation Formula

Understanding how realtor commission is calculated in BC is key to planning your finances when selling your home. While the specifics can vary, the general principle remains the same: it’s a percentage of the final sale price. Let’s break down the typical commission structure and how it works.

In BC, the seller traditionally pays the commission, which is split between the seller’s agent (listing agent) and the buyer’s agent. This means that the sale price of your property determines the total commission amount, which is divided between the two agents who facilitated the transaction.

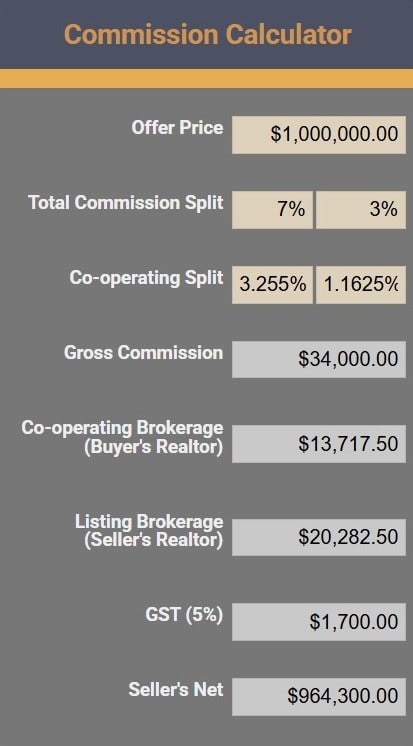

Here’s an example of how commission might be calculated using the rates I typically charge: I charge a realtor fee of 7% on the first $100,000 of the sale price and 3% on the remaining balance. To ensure a competitive offer for buyer realtors to show your property, I offer the buyer’s agent 3.255% on the first $100,000 and 1.1625% on the remaining balance.

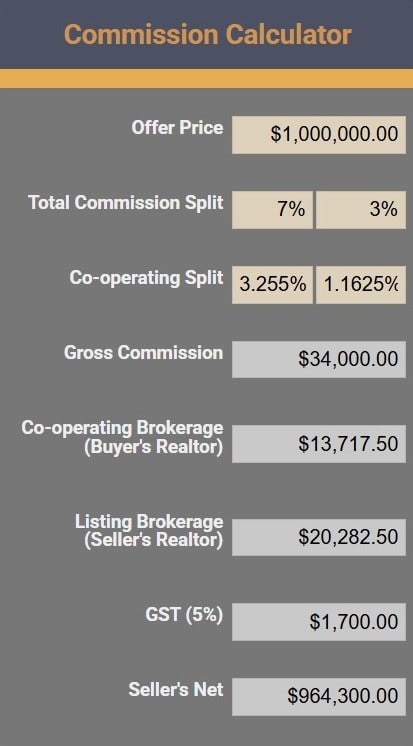

Let’s illustrate with a $1,000,000 property:

Total Realtor Commission:

-

- 7% of the first $100,000 = $7,000

- 3% of the remaining $900,000 = $27,000

- Total Fee: $7,000 + $27,000 = $34,000

Buyer Agent Commission:

-

- 3.255% of the first $100,000 = $3,255

- 1.1625% of the remaining $900,000 = $10,462.50

- Total Fee: $3,255 + $10,462.50 = $13,717.50

Seller Agent Commission:

-

- Total Realtor Commission ($34,000) – Buyer Agent Commission ($13,717.50) = Seller Realtor Commission ($20,282.50)

In this example, the total commission is $34,000, split approximately 60/40 between the listing agent (myself) and the buyer’s agent. It’s important to note that the buyer agent’s portion is paid from the total commission, not in addition. Sellers sometimes mistakenly believe they pay both commissions separately.

It’s also crucial to remember that commission rates are negotiable. While the example above reflects my standard rates, other realtors and brokerages may have different structures. The best approach is to openly discuss with your chosen realtor their fees and how they calculate their commission. Don’t hesitate to ask questions and clarify any points you’re unsure about. Transparency is key to a smooth and successful real estate transaction.

Let’s tackle these common questions about realtor commission in BC:

- How is realtor commission calculated in BC? Realtor commission is a percentage of the property’s final sale price. The rate can vary, but it’s typically split between the seller’s agent (listing agent) and the buyer’s agent. While the seller usually pays the entire commission, it’s important to remember that this fee covers the services of both agents.

- How much are realtor fees in BC? Realtor fees, also known as realtor commissions, are not fixed. They can differ significantly between realtors and brokerages. Some may charge higher rates, while others may offer lower rates. The amount can also be influenced by the type of property, its location, and the range of services the realtor provides. It’s crucial to discuss this with any potential realtor upfront.

- How much is the real estate commission in BC? Just like realtor fees, real estate commission amounts are not standardized across the board. There is no set percentage that all realtors must adhere to. The commission is a matter of negotiation between the seller and the realtor.

- How much percent do realtors get? The percentage BC realtors receive varies. There’s no single answer. It can depend on the individual realtor, the brokerage they work for, the specific agreement with the seller, and the services provided. Some realtors charge a higher percentage for premium services or unique properties. In contrast, others offer lower percentages, especially in competitive markets.

- How much commission does a realtor make in BC? A realtor’s income from a single transaction depends on the agreed-upon commission rate and the property’s sale price. Since both factors vary widely, it’s impossible to state a typical income figure. Furthermore, realtors often split their commissions with their brokerage. The amount a realtor takes home also depends on their brokerage commission split.

- How much is the realtor commission in BC? Again, the realtor commission in BC is not a fixed amount. It’s best to think of it as a negotiable fee that varies. Don’t assume there’s a “standard” rate. Always discuss commissions with potential realtors and compare their offerings before deciding. Remember, a lower commission rate doesn’t necessarily mean lesser service, and a higher rate doesn’t guarantee the best results. Consider the complete package of services, experience, and market knowledge when choosing a realtor.

Vancouver Realtor Commission: A Closer Look

Navigating the Vancouver Market

Vancouver’s real estate market is unique, dynamic, and often highly competitive. While the general principles of realtor commission apply across BC, there are some nuances to consider when buying or selling in Vancouver. Due to the higher property values and specific market conditions, understanding commission structures in this area is particularly important.

Like the rest of the province, realtor commissions in Vancouver are not fixed by law. They are negotiable between the seller and the real estate agent. However, trends and typical ranges may emerge due to the Vancouver market’s competitive nature. It’s not uncommon to see commission structures similar to those elsewhere in BC, often involving a percentage of the sale price split between the listing and buyer’s agents.

Here’s what you should know about Vancouver realtor commissions:

- Negotiation is Key: Don’t hesitate to negotiate commission rates with Vancouver realtors. While some agents may have standard rates, most are open to discussion, especially in a competitive market.

- Market Conditions Matter: The state of the Vancouver real estate market can influence commission rates. Realtors might be less flexible on commission in a seller’s market, where demand and inventory are low. Conversely, there might be more room for negotiation in a buyer’s market.

- Services Offered: The realtor’s range of services can also affect the commission. Some realtors offer comprehensive packages that include staging, professional photography, and extensive marketing, while others may offer more basic services. Discuss what’s included in the commission and how it aligns with your needs.

- Experience and Expertise: Experienced and highly specialized realtors in Vancouver may command higher commission rates due to their proven track record and in-depth local market knowledge. Consider the value they bring to the table when negotiating commission.

Addressing some common questions about Vancouver realtor commissions:

- What are Vancouver real estate agent commissions? These fees are paid to real estate agents in Vancouver for their services, typically calculated as a percentage of the sale price.

- How much are real estate fees in Vancouver? Real estate fees in Vancouver are variable and negotiable. They are not set by any regulatory body.

In summary, navigating the Vancouver real estate market requires a thorough understanding of commission structures. Don’t hesitate to ask questions, negotiate rates, and compare services before selecting a realtor. A well-informed decision will help you achieve your real estate goals in this competitive market.

RE/MAX Realtor Commission in BC: What to Expect

Understanding RE/MAX Fee Structures

RE/MAX is a well-known real estate franchise with a significant presence in BC. If you’re considering working with a RE/MAX agent, understanding their commission structure is essential. It’s important to remember that RE/MAX is a franchise, meaning individual offices are independently owned and operated. Therefore, while there might be some general similarities, commission rates are not standardized across all RE/MAX agents.

Like other real estate professionals in BC, RE/MAX agents typically work on commission. This commission is a percentage of the sale price paid by the seller. However, the specific percentage can vary. Each RE/MAX agent runs their own business and can set their rates.

Here’s what you should know about RE/MAX realtor commissions in BC:

- Independent Contractors: RE/MAX agents are independent contractors, not employees. They can draft their commission structures, allowing them to tailor strategies that align with their unique goals!

- Negotiation is Possible: Don’t assume that a RE/MAX agent’s quoted commission is set in stone. Commission rates are often negotiable, and it’s always worth discussing with the agent about their fees.

- Market Factors: Like all realtors, RE/MAX agents are influenced by market conditions. In a competitive market, they might be more open to negotiation.

- Services Provided: The RE/MAX agent’s range of services can also affect the commission rate. Discuss what’s included in their service package and how it justifies their commission.

- Individual Agent Variations: It’s crucial to understand that RE/MAX agents are individuals with their own business practices. Commission rates vary significantly from one RE/MAX agent to another, even within the same office.

Addressing common questions about RE/MAX realtor commissions in BC:

- How much are RE/MAX realtor commission rates in BC? There’s no single answer. RE/MAX commission rates vary between individual agents and offices. You must contact specific RE/MAX agents to inquire about their rates.

- What are RE/MAX realtor fees BC? RE/MAX realtor fees are the commission’s RE/MAX agents charge in BC. These fees are not fixed and can differ.

In short, when working with a RE/MAX agent in BC, don’t hesitate to ask about their commission structure upfront. Be prepared to discuss your needs and expectations, and remember that negotiation is often possible. Just because an agent works for RE/MAX doesn’t mean their commission rates differ from other BC realtors. It’s all about the individual agent and your agreement with them.

Introducing the BC Realtor Fee Calculator: Your Instant Estimation Tool

Calculate Your Costs with Ease!

Selling your home involves many moving parts, and understanding the financial implications is paramount. That’s why we’ve developed the BC Realtor Fee Calculator, a user-friendly tool designed to estimate your realtor commission costs and, most importantly, your net proceeds from the sale. This calculator empowers you to explore different scenarios and make informed decisions about your pricing strategy and budget.

How to Use the BC Realtor Fee Calculator:

This calculator is designed to be incredibly simple and intuitive. Just follow these steps:

- Enter Your Estimated Selling Price: In the “Offer Price” box, input your estimated selling price for your home. This is the price you anticipate receiving from a buyer. Be as realistic as possible with this number, considering recent comparable sales in your area.

- Review the Results: Once you’ve entered the offer price, the calculator will instantly generate several key figures:

- Gross Commission: This is the total estimated commission based on the default commission rate (which you can adjust).

- Listing Agent Commission: This portion of the commission would go to the listing agent (your agent).

- Buyer Agent Commission: This portion of the commission would go to the buyer’s agent.

- GST (5%) on Realtor Commission: Shows the Goods and Services Tax applicable to the realtor commission.

- Seller’s Net: This is the most important number! It represents the estimated amount you, as the seller, will receive after the realtor commission and GST are deducted from the sale price.

- Experiment with Different Offer Prices: One of the most valuable features of the calculator is the ability to test different offer prices quickly. Change the value in the “Offer Price” box, and the results will update automatically. This lets you see how your net proceeds vary depending on the final selling price.

- Adjust the Commission Percentage: You can also adjust the commission percentage to see how changes in the commission rate affect your net proceeds. This is particularly useful when discussing commission with your realtor. You can model different scenarios and understand the impact of different rates.

Benefits of Using the BC Realtor Fee Calculator:

- Instant Estimations: Get quick and accurate calculations of your commission costs and net proceeds.

- Easy to Use: The interface is simple and intuitive, requiring no specialized knowledge.

- Scenario Planning: Explore different offer prices and commission rates to understand their impact on your finances.

- Informed Decision-Making: Empower yourself with the information to make sound pricing and commission negotiation decisions.

- No Obligation: The calculator is free to use and doesn’t require you to provide any personal information.

The BC Realtor Fee Calculator is valuable for any homeowner considering selling their property. It takes the guesswork out of commission calculations. It gives you the clarity you need to navigate the selling process confidently. Try it out today and see how it can help you plan your next move!

Negotiating Realtor Commission: Tips for Home Sellers

Your Guide to Commission Negotiations

While understanding how realtor commission works is essential, knowing how to negotiate it effectively is equally important. Remember, commission rates are negotiable, and it’s within your right as a seller to discuss this aspect of the transaction with potential realtors. Here are some valuable tips to help you navigate commission negotiations successfully:

- Do Your Research: Before contacting realtors, research typical commission rates in your area. This will give you a benchmark to work with and help you understand what’s reasonable. Online resources, recent sales data, and conversations with other homeowners can be helpful.

- Shop Around and Compare: Don’t settle for the first realtor you meet. Interview several agents and compare their services, experience, and commission structures. This will give you a broader perspective and allow you to choose the best fit for your needs.

- Be Prepared to Discuss Value: When negotiating commission, focus on the value the realtor brings to the table. What specific services do they offer? How will their marketing strategy benefit you? What is their track record in selling similar properties? Justify your negotiation based on the value you expect to receive.

- Don’t Be Afraid to Negotiate: Many sellers hesitate to negotiate commission, but it’s a perfectly acceptable practice. Realtors are accustomed to negotiations, and most are willing to discuss their rates, especially in competitive markets.

- Consider Market Conditions: The current real estate market can influence your negotiating power. In a buyer’s market with more sellers than buyers, you might have more leverage to negotiate a lower commission. Conversely, in a seller’s market, realtors might be less flexible.

- Be Clear About Your Expectations: Before entering into a listing agreement, be clear with the realtor about your commission expectations. Please don’t wait until later in the process to bring it up. Open communication from the start is crucial.

- Focus on the Net Proceeds: What matters most to you as a seller is the net proceeds you receive from the sale. Use the BC Realtor Fee Calculator to model different commission scenarios and see how they impact your bottom line. This will help you stay focused on your financial goals.

- Get Everything in Writing: Once you’ve reached an agreement on the commission rate, make sure it’s documented in the listing agreement. This will prevent any misunderstandings or disputes later on.

By following these tips, you’ll be well-equipped to confidently navigate commission negotiations and achieve the best possible outcome when selling your home. The goal is to reach a mutually beneficial agreement for both parties.

Empowered Seller: Making Informed Decisions About Realtor Commission

Selling your home is a significant financial decision, and understanding the realtor commission in BC is a crucial part of the process. We’ve covered much ground in this guide, from defining realtor fees and how they’re calculated to providing tips for negotiating commission and introducing our handy BC Realtor Fee Calculator. The key takeaway is that knowledge is power. By understanding the intricacies of realtor commissions, you can make informed decisions that align with your financial goals and ensure a smooth and successful selling experience.

Let’s recap the key points:

- Realtor commission in BC is a fee paid to real estate agents for their services, typically calculated as a percentage of the sale price.

- The seller usually pays the commission, which is split between the listing agent and the buyer’s agent.

- Commission rates are negotiable and can vary depending on the realtor, brokerage, market conditions, and services provided.

- Vancouver’s real estate market has unique quirks that make it interesting, and the competitive landscape can influence commission rates.

- RE/MAX agents, like other realtors, operate on a commission basis, but their rates are determined individually.

- Our BC Realtor Fee Calculator is a valuable tool for estimating commission costs and net proceeds.

- Negotiating commission is typical, and being prepared and informed is essential.

By now, you should have a much clearer understanding of realtor commissions in BC. You know what it is, how it’s calculated, and how to discuss it with realtors. You also have a valuable tool – the BC Realtor Fee Calculator – to help you make informed financial decisions. Remember, transparency is key. Don’t hesitate to ask realtors about their commission structures, compare their services, and negotiate a rate that works for you.

Ultimately, the goal is to sell your home for the best possible price while also being comfortable with the commission you pay. With the information in this guide and the help of our calculator, you’re well on your way to making informed decisions and achieving your real estate objectives.

Unlock Your Home’s Full Potential: A Tailored Plan for Maximum Results

Ready to take the next step in selling your home? Understanding realtor commission is just the beginning. To truly maximize your return and navigate the complexities of the BC real estate market, you need a trusted and experienced real estate professional by your side.

I’m Sam Huang, a seasoned real estate agent with over 15 years of experience helping homeowners in Vancouver and across BC achieve their real estate goals. I’m committed to providing personalized service, expert guidance, and proven results. Whether you’re just starting to explore your options or are ready to list your property, I’m here to help.

Here’s how you can connect with me:

- Call me directly: For a personalized consultation and to discuss your specific needs, please don’t hesitate to call me at 778-991-0649. I’m available to answer your questions and provide expert advice.

- Contact me online: You can also reach me through my website’s contact form: https://realestatecoalharbour.com/contact-me/. Fill out the form, and I’ll get back to you promptly.

I understand that selling your home is a big decision, and I’m here to make the process as smooth and stress-free as possible. From market analysis and pricing strategies to negotiation and closing, I’ll be your dedicated advocate every step of the way. Don’t leave money on the table – contact me today, and let’s discuss how I can help you achieve your real estate objectives. I look forward to hearing from you!

Frequently Asked Questions (FAQ) About Realtor Commission in BC

We understand that you still have some questions about realtor commissions in BC. This FAQ section addresses some of the most common inquiries we receive. If you don’t find your answer here, please don’t hesitate to contact us directly – we’re happy to help!

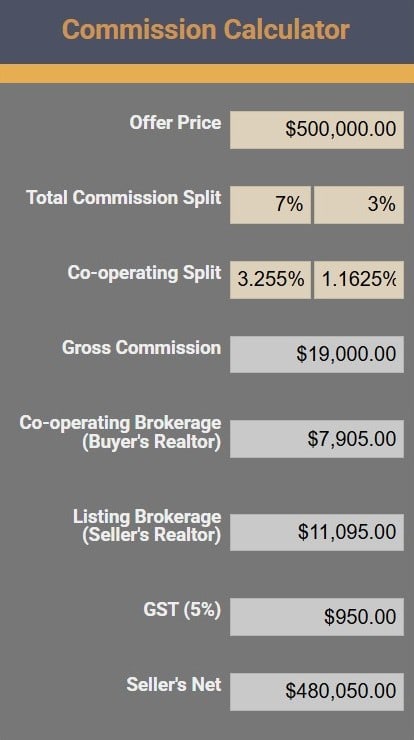

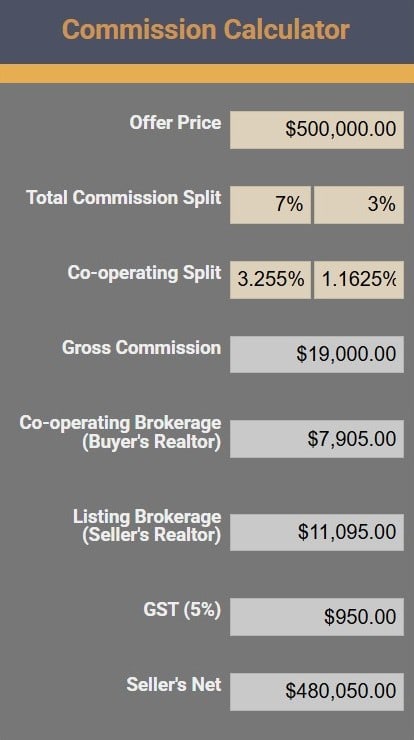

How much does a realtor make on a $500,000 sale?

- A realtor’s commission on a $500,000 sale depends entirely on the agreed-upon commission rate. Since rates are negotiable and vary, there’s no fixed amount. Let’s say, for example, the total commission is $19,000, split between the listing and buyer’s agents. In this scenario, the listing agent would receive $11,095, and the buyer agent would receive $7,905. However, this is just an example; the actual amount could be higher or lower. Additionally, realtors often split their commission with their brokerage, so their take-home pay would be a portion of that amount.

How much commission does a realtor make?

- A realtor’s commission varies significantly. It depends on the property’s sale price, the agreed-upon commission rate (which is negotiable), and whether they are the listing agent or the buyer’s agent. Additionally, realtors typically split their commission with their brokerage. Therefore, the amount a realtor “makes” on a transaction is a portion of the commission they receive after the brokerage split.

How much do realtors make in BC?

- Realtors’ earnings in BC are highly variable. They depend on the number of transactions they close, the average sale price of properties they handle, and their commission rate. Some realtors specialize in luxury homes with higher price tags, leading to larger commissions, while others focus on strata properties. Therefore, there’s no typical income for realtors in BC.

How do real estate agents get paid?

- Real estate agents get paid through commissions. This commission is a percentage of the sale price of a property and is typically paid by the seller. The total commission is usually split between the listing agent and the buyer’s agent.

Who pays realtor fees, buyer or seller in Canada?

- In Canada, it’s customary for the seller to pay the realtor fees, which are then split between the seller’s agent and the buyer’s agent. The buyer typically does not pay the commission directly.

What percentage do most realtors charge in BC?

- There’s no “most” standard percentage. Commission rates are negotiable and can vary widely. While you might see some typical ranges, there’s no standard rate that all realtors charge. It’s essential to discuss commissions with individual realtors.

What’s the cost of selling a house in BC?

- The cost of selling a house in BC includes several factors. The most significant cost is usually the realtor commission. Other costs include legal fees, staging costs, marketing expenses, and potentially capital gains taxes. The exact cost will depend on the specifics of your sale.

Can I sell my house without a realtor?

- You can sell your house without a realtor (often called “For Sale By Owner” or FSBO). However, this requires a significant time investment and a good understanding of the real estate market, legal requirements, and negotiation skills.

How much are real estate lawyer fees in BC?

- Real estate lawyer fees in BC vary depending on the complexity of the transaction and the lawyer’s rates. It’s best to contact real estate lawyers directly for quotes.

Can you negotiate realtor fees in BC?

- Yes, you can negotiate realtor fees in BC. Commission rates are not fixed and are subject to negotiation between the seller and the realtor.

Do I need to pay a Realtor commission when buying a Condo in Vancouver?

- Buyer’s typically don’t pay a Realtor fee when buying a Condo in Vancouver. When buying a condo in Vancouver, if you are working with a Buyer realtor, your realtor will receive a real estate commission from the Seller. When working with a Realtor to help you buy a condo, your realtor is required to disclose to you the amount he/she will receive upon successful completion of the sale.

I am a foreign resident. Do I need to pay a Realtor commission when selling a condo in Vancouver?

- All the home sellers in BC need to pay Real Estate Commission regardless if the Seller is a Canadian or foreign resident (meaning you don’t have a landed immigrant or Canadian permanent resident status).

Related Readings