Table of Contents

Input your sale price to get a clear, itemized Seller’s Statement of Estimated Net Proceeds. You can also efficiently run different scenarios by changing the total commission, buyer’s commission (cooperating agent), and legal fees.

“Use the calculator to determine exactly how much to budget for closing costs and what your net cheque will look like.”

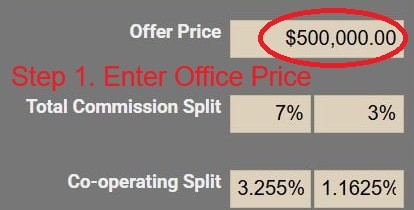

Step 1. Enter Your Estimated Selling Price: In the “Offer Price” box, input your estimated selling price for your home. This is the price you anticipate receiving from a buyer. Be as realistic as possible with this number, considering recent comparable sales in your area.

Step 2. Review the Results: Once you’ve entered the offer price, the calculator will instantly generate several key figures:

Step 3. Experiment with Different Offer Prices: One of the most valuable features of the calculator is the ability to test different offer prices quickly. Change the value in the “Offer Price” box, and the results will update automatically. This lets you see how your net proceeds vary depending on the final selling price.

Step 4. Adjust the Commission Percentage: You can also adjust the commission percentage to see how changes in the commission rate affect your net proceeds. This is particularly useful when discussing commission with your realtor. You can model different scenarios and understand the impact of different rates.

Step 5. Adjust the Lawyer’s Fee and Adjustment amount: Changing the lawyer’s fee and adjustment amount to get a more accurate picture of the final cost of selling a home.

Congratulations—you’re preparing to sell your home in Vancouver, BC! While securing a great sale price is exciting, knowing your actual take-home amount is what really matters. The complexity of seller closing costs often leaves homeowners guessing how much they will truly net. This guide cuts through the confusion, clearly defining every fee. Best of all, we introduce the BC Home Seller Closing Costs Calculator—your essential tool for immediate, accurate home sale net proceeds calculation.

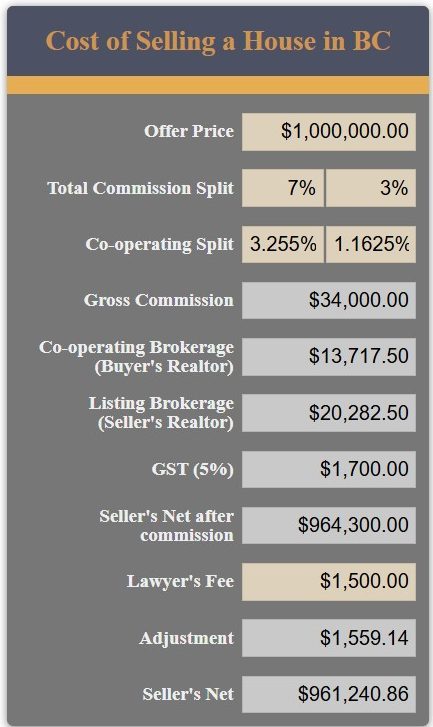

We’ll jump right into with the following detailed estimate of the costs associated with selling a $1,000,000 home in BC, concluding with the Home Seller’s Net Proceeds.

Realtor Commission (The Gross Commission):

GST on Commission (5%): The 5% Goods and Services Tax on the total commission is added, amounting to $1,700.00 ($34,000 x 0.05).

Legal Fees: An estimated legal fee of $1,500.00 is deducted for the lawyer or notary public handling the conveyance, drafting the final documents, and executing the Statement of Adjustments.

Adjustment: Estimated adjustment fee of $1,559.14

Seller’s Net: After subtracting the commissions, GST, legal fees, and adjustments, the seller’s estimated net is $961,240.86.

The Adjustment line item ($1,559.14 in this example) is crucial for understanding the final net figure. It addresses the prorating of costs between the seller and buyer.

“Adjustments” represent a catch-all line item on the final Statement of Adjustments prepared by your lawyer. This figure is primarily intended to account for various expenses that the seller may have paid in advance for a period that extends past the closing date, or, conversely, expenses owed by the seller up to the closing date.

The most common item represented in this adjustment is the proration of Property Taxes.

In this specific calculation, since the $1,559.14 is shown as a deduction from your proceeds, the seller is likely responsible for paying their partial share of outstanding costs, such as property taxes, strata fees, or utilities, up to the closing date. Your lawyer ensures these funds are held and paid on your behalf to the relevant party (municipality, strata, or buyer) to clear your obligations.

Closing costs are mandatory fees and adjustments deducted from your final sale price. They are the expenses required to transfer ownership and finalize the transaction legally. Here are the major deductions when selling a home in BC.

Unlike buying a home (where the buyer pays Property Transfer Tax), the responsibility for most closing costs in a sale falls squarely on the seller.

The distinction between buyer and seller costs is fundamental for budgeting. In British Columbia, the seller is the party responsible for the fees that facilitate the transaction, differentiating their costs from the buyer’s, who must shoulder the substantial financial weight of the Property Transfer Tax (PTT).

This seller burden is heavily concentrated in the real estate commission, which is the fee paid to the listing brokerage and then split with the buyer’s cooperating brokerage for securing the sale. Furthermore, the seller pays for their own legal or notary fees to handle the conveyance, ensuring the title is legally cleared and transferred to the new owner. All of these transactional expenses, including any remaining mortgage payout and adjustments for items like property taxes, are deducted automatically from the gross sale price at closing. Ultimately, the seller’s closing costs are a reflection of the professional services required to successfully market, negotiate, and finalize the property transfer.

Stop guessing! Determining your estimated net proceeds is simple when you use the BC Home Seller Closing Cost Calculator. This calculator factors in realtor commission, GST on commission, legal fees, and adjustments. Please note that this calculator assumes the property has a clear title and no mortgage. To find out your closing cost, enter the offer price, and the calculator will do the rest. You may do scenario planning by changing the commission amount and the lawyer’s fee.

How much does it cost to sell a house in British Columbia? Home sellers can typically expect selling costs to range from 3% to 6% of the sale price. The final cost will depend on several factors, including the sale price, real estate commission, complexity of the sale, and lawyer fees, among others. Here’s a quick and easy way to estimate the selling costs.

For home sellers concerned about paying the closing costs, there’s good news. You don’t need to write a cheque upfront for the aforementioned closing costs. Here’s how the closing costs are paid. Through the “Statement of Adjustments.”

Process: Your lawyer/notary prepares a final financial document on closing day. All seller costs (commissions, mortgage payout, legal fees, adjustments) are deducted automatically from the gross sale price.

Net Proceeds: The remaining balance—your net proceeds—is then wired to your bank account, typically within 1–3 business days after the completion date.

Selling your home in BC doesn’t have to mean financial surprises. By understanding the components of closing costs—from how much realtor fees are in bc to the final Statement of Adjustments—you can sell with confidence.

Ready to see your estimated net proceeds? Click here to use the BC Home Seller Closing Costs Calculator now, or contact me, Sam Huang, your trusted RE/MAX Vancouver specialist, for a personalized net sheet consultation.

Sam Huang PREC

H & S Real Estate Group

Real Estate Coal Harbour

RE/MAX Select Properties

Address: 5487 West Boulevard, Vancouver BC V6M 3W5, Canada

Phone: 778-991-0649

WeChat: ubchomes

QQ: 2870029106

Email: Contact Me