Table of Contents

You’ve found the perfect home in Vancouver and celebrated the accepted offer. You’re already juggling mortgage details, down payment funds, and inspection dates, etc. and then someone mentions the BC Property Transfer Tax (PTT). Suddenly, you realize this isn’t a small fee, but a potential five-figure expense that was never properly budgeted for. All you can think is: “How much is this going to cost me, and do I even qualify for an exemption?”

The truth is, calculating the BC Property Transfer Tax for a first-time home buyer is unnecessarily complicated. You spend hours digging through conflicting government web pages, seeing complex formulas (1% on the first $200,000, 2% on the balance…) and trying to apply them to your unique situation. Then you find the First-Time Home Buyer Exemption, but wait—does your property’s value qualify for the full exemption, or just a partial one? What if you’re buying a new build? This confusion turns an exciting milestone into a stressful guessing game, leaving you anxious that you might be blindsided by thousands of dollars in hidden closing costs. You need a clear, definitive answer—not more complicated government tables.

Stop guessing and start budgeting with confidence. As a Vancouver Realtor with over a decade of experience, I’ve heard this exact stress from countless first-time buyers. That’s why I created the All-in-One BC Property Transfer Tax Calculator—the only tool you’ll ever need to cut through the confusion. In this post, you’ll learn everything about the BC PTT, and you’ll get instant, accurate results from the calculator that tells you exactly what you owe and how much you save through available exemptions, whether you’re a first-time or repeat Buyer.

Step 1. Enter your estimated purchase price. In the “Purchase Price” box, enter the home purchase price. After the purchase price is entered, the calculator will calculate the total Property Transfer Tax payable on completion.

Step 2. Select your status. By default, the “I am a citizen or permanent resident of Canada” and “I am using the home as a principal residence” are selected. If you are not a Canadian citizen or permanent resident, please deselect the “I am a citizen or permanent resident of Canada” box. If you are buying the property as an investment property and not using it as your principal residence, please deselect the “I am using the home as a Principal Residence” box.

Step 3. Select your exemptions. If you are a first-time home buyer in BC, please select the “I am a first-time home buyer” box. If you are buying a newly constructed home, please select the “I am buying a newly constructed home” box.

Step 4. Experiment with different purchase prices. You can change the purchase price to see how buying a home at different price points affects the property transfer tax. This is particularly useful when determining whether the purchase price exceeds the exemption threshold.

The Property Transfer Tax (PTT) is a land registration tax paid by the home buyer in BC when a property title is registered at the Land Title and Survey Authority (LTSA). BC Property Transfer Tax Act was first introduced in BC in 1987. In the beginning, it was called the Property Purchase Tax to discourage real estate speculation. Later, the BC government renamed it Property Transfer Tax.

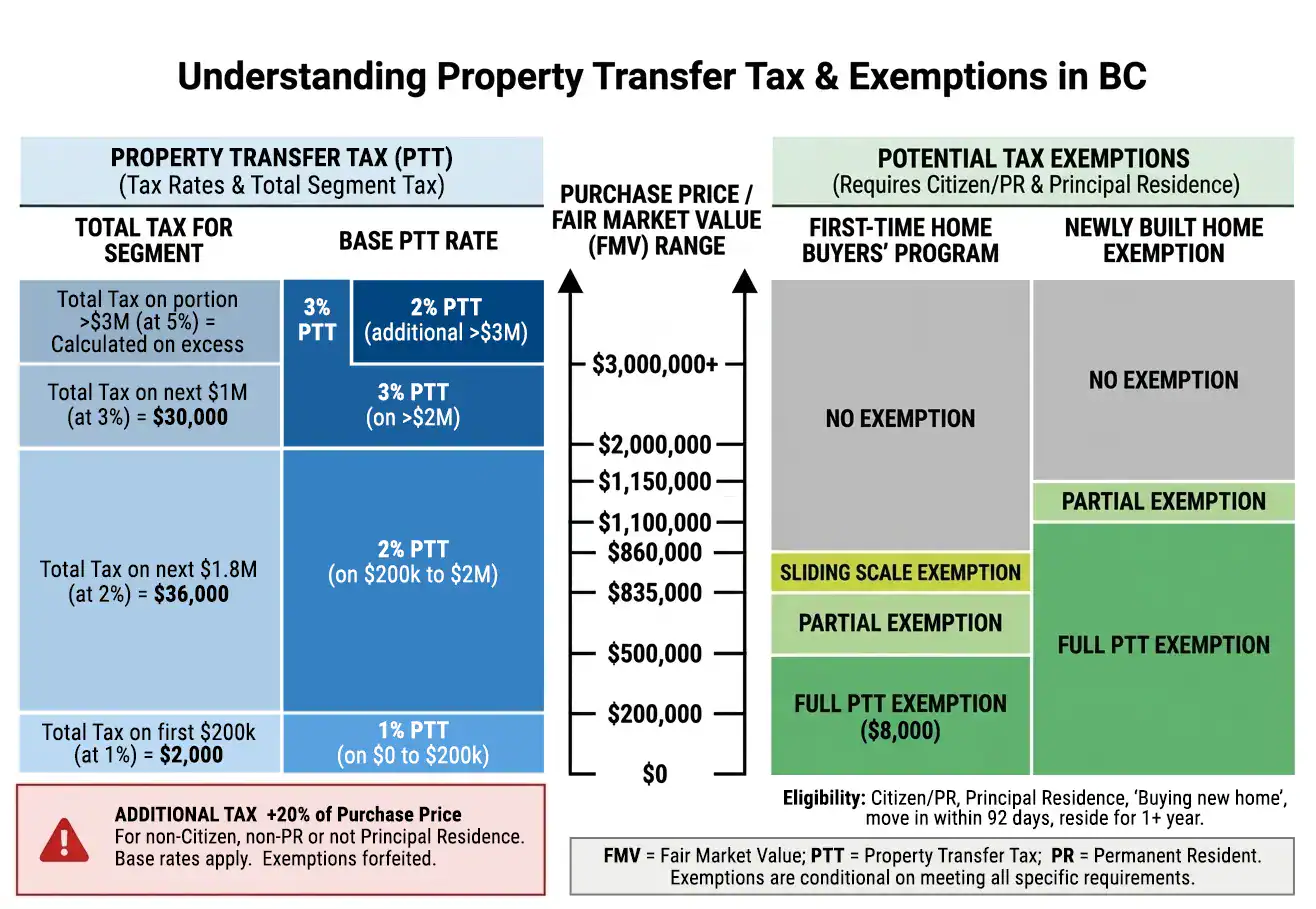

| Purchase Price of Home | Property Transfer Marginal Tax Rate |

|---|---|

| First $200,000 | 1.0% |

| $200,000 to $2,000,000 | 2.0% |

| portion of the fair market value over $2,000,000 | 3.0% |

| portion of the fair market value over $3,000,000 | 2.0% |

To help home buyers in Vancouver and other cities in BC, the British Columbia provincial government also offers property transfer tax exemptions for qualified home buyers. The exemptions can help buyers reduce the amount of transfer tax they need to pay.

Typically, the lawyer or notary public handles the payment of the property transfer tax on the completion date. If you have any questions about PTT and exemptions, you can contact your real estate lawyer in Vancouver.

There are many ways home buyers can qualify for the property transfer tax exemption. Below are the exemption programs available to home buyers in BC.

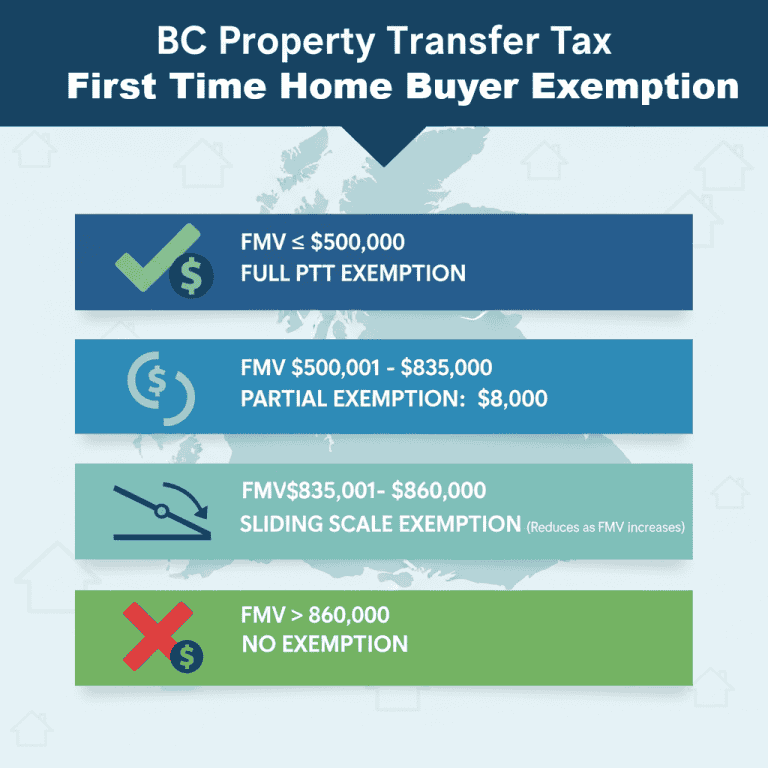

All first-time home buyers in BC can qualify for the First Time Home Buyers’ Exemption. This program reduces or eliminates the BC property transfer tax. If you are qualified for the program, you may be eligible for either a full or partial exemption from the transfer tax.

If one or more buyers don’t qualify, only the percentage of interest that the first-time home buyer(s) have in the property is eligible. For example, if you are buying a property with a partner, and the property has a fair market value of $500,000, if one of you is qualified and the other is not. If one of them owns a 50% interest in the property, 50% of the tax amount would be eligible for the exemption.

Please note that Foreign Buyers are not eligible for the First-Time Home Buyers’ Program exemption. Click here to learn more if you are a foreign buyer planning to buy a home in Vancouver.

| Purchase Price of Home | First-Time Buyer Exemption |

|---|---|

| Up to $500,000 | Full exemption |

| From $500,000 to $835,000 | Partial exemption of $8,000, See Calculator |

| Over $835,000 and under $860,000 | Sliding scale exemption, See Calculator |

| Over $860,000 | No exemption |

| Scenario | Fair Market Value | PTT Without Exemption | FTHBE Status | PTT Savings/Exemption | Final PTT Due |

|---|---|---|---|---|---|

| 1: Full Exemption | $500,000 | $8,000 | FULL | $8,000 | $0 (You pay nothing!) |

| 2: Partial Exemption | $750,000 | $13,000 | PARTIAL | $8,000 | $5,000 |

| 3: No Exemption | $890,000 | $15,800 | NO | $0 | $15,800 |

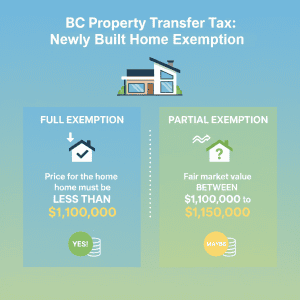

The Newly Built Home Exemption program reduces or eliminates the property transfer tax when buying a new or newly built home.

There’s a partial exemption for the property with a fair market value between $1,100,000 and $1,150,000.

| Purchase Price of Home | New Home Buyer Exemption |

|---|---|

| Up to $1,100,000 | Full exemption |

| From $1,100,000 to $1,150,000 | Partial exemption, See Calculator |

| Over $1,150,000 | No exemption |

| Scenario | Fair Market Value | PTT Without Exemption | NHBE Status | PTT Savings/Exemption | Final PTT Due |

|---|---|---|---|---|---|

| 1: Full Exemption | $1,100,000 | $20,000 | FULL | $20,000 | $0 (You pay nothing!) |

| 2: Partial Exemption | $1,135,000 | $20,700 | PARTIAL | $6,210 | $14,490 |

| 3: No Exemption | $1,250,000 | $23,000 | NO | $0 | $23,000 |

Foreign buyers are not eligible for the First-Time Home Buyer and Newly Built Home property transfer tax exemption. However, if the foreign buyer becomes a Canadian citizen or permanent resident within 12 months after the property is registered, the buyer may apply for a refund of the property transfer Tax.

There are numerous property transfer tax exemptions for family members. See below for details of the Family member exemptions.

In addition to the First Time Home Buyer and New Home exemption programs, other exemption programs are available to help reduce or eliminate property transfer tax.

This property transfer tax bc calculator is provided for general information purposes only. Real Estate Coal Harbour does not guarantee the accuracy of the information displayed and is not responsible for any consequences arising from the use of the calculator.

If you are a home buyer and qualifies for any of the PTT exemptions, your lawyer or notary public will help you file the BC property transfer tax and claim the exemptions.

A home buyer may receive the PTT refund if he or she meets the following criteria.

Click here to view various BC Property Transfer Tax Forms.

In British Columbia, a home buyer must file the property transfer tax return and pay all the property transfer tax when registering an interest in a property. Foreign buyers must also file the Additional Property Transfer Tax Return (FIN 532) with the property transfer tax return.

If the property value is over $3,000,000, the buyer must pay the further 2% tax and complete the PTT for residential properties over $3,000,000 (FIN 536).

Due to the property transfer tax complexities, I recommend all my buyers to hire either a lawyer or notary public to help file the Property Transfer Tax return.

Home buyers need to be aware that the property transfer tax applies to pre-construction condo or strata units. The property transfer tax is payable on the completion date. PTT exemptions apply to pre-sales condos and townhouses.

Buyers pay property transfer tax on the total amount paid to acquire the property. The total amount includes any money paid for upgrades, additions, or any other premium for the assignment of a written agreement.

The buyer can transfer the right to purchase the property to a related individual (brothers and sisters not included) before the property is registered at the land title office without incurring the PTT.

The same rule for PTT also applies to the foreign buyers buying a pre-construction condo.

Click here to view details of Property Transfer Tax on Pre-sold Strata Units.

Property transfer tax varies depending on the price of the home. Click here to view BC Property Transfer Tax Rates.

Home Buyer pays for the Property Transfer Tax in BC.

The Property Transfer Tax (PTT) is a land registration tax paid by the home buyer in BC when a property title is registered at the Land Title and Survey Authority.

BC government offers numerous exemptions to qualified home buyers. The exemptions help to reduce and eliminate the Property Transfer Tax. Click here to see if you qualify for Property Transfer Tax Exemptions.

I have created a property transfer tax BC calculator to help buyers calculate the PTT. Click here to use the property transfer tax calculator.

Property transfer tax applies to new homes in BC. However, you may be exempted from the PTT if you are using the new home as your principal residence and the new home is less than $1,150,000.

Sam Huang PREC

H & S Real Estate Group

Real Estate Coal Harbour

RE/MAX Select Properties

Address: 5487 West Boulevard, Vancouver BC V6M 3W5, Canada

Phone: 778-991-0649

WeChat: ubchomes

QQ: 2870029106

Email: Contact Me