Table of Contents

Selling your home involves many moving parts, and understanding the financial implications is paramount. That’s why we’ve developed the BC Realtor Fee Calculator, a user-friendly tool designed to estimate your realtor commission costs and, most importantly, your net proceeds from the sale. This calculator empowers you to explore different scenarios and make informed decisions about your pricing strategy and budget.

This calculator is designed to be incredibly simple and intuitive. Just follow these steps:

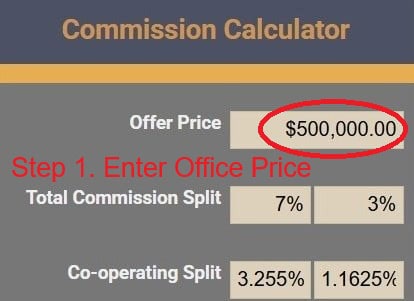

Step 1. Enter Your Estimated Selling Price: In the “Offer Price” box, input your estimated selling price for your home. This is the price you anticipate receiving from a buyer. Be as realistic as possible with this number, considering recent comparable sales in your area.

Step 2. Review the Results: Once you’ve entered the offer price, the calculator will instantly generate several key figures:

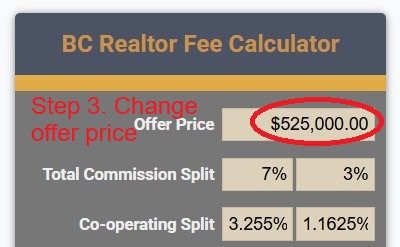

Step 3. Experiment with Different Offer Prices: One of the most valuable features of the calculator is the ability to test different offer prices quickly. Change the value in the “Offer Price” box, and the results will update automatically. This lets you see how your net proceeds vary depending on the final selling price.

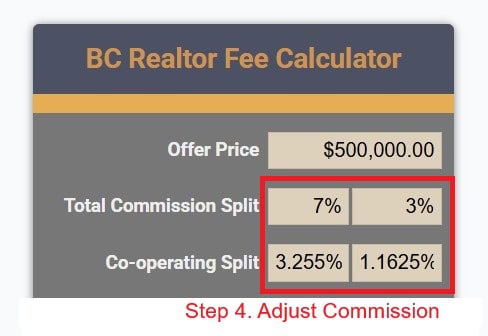

Step 4. Adjust the Commission Percentage: You can also adjust the commission percentage to see how changes in the commission rate affect your net proceeds. This is particularly useful when discussing commission with your realtor. You can model different scenarios and understand the impact of different commission rates.

Benefits of Using the Realtor Fee Calculator:

The Realtor Fee Calculator is valuable for any homeowner considering selling their property. It takes the guesswork out of commission calculations. It gives you the clarity you need to navigate the selling process confidently. Try it out today and see how it can help you plan your next move!

Selling your home or condo is a monumental decision, filled with excitement, anticipation, and… a touch of confusion, especially regarding realtor commissions. Let’s face it: navigating the world of real estate fees can feel like deciphering a secret code. Many homeowners are scratching their heads, wondering, “How much will this cost me?” You’re not alone. Understanding realtor commissions is a crucial piece of the puzzle. Without it, you could be left with unexpected expenses and a less-than-ideal experience.

Many sellers rely on rumours or outdated information about commission. They might worry about hidden fees, unclear percentages, or feeling in the dark about the whole process. This lack of clarity can lead to anxiety, budget miscalculations, and even resentment towards the realtors involved. You might be asking yourself: What’s the standard rate? Is it negotiable? How does it all work? Without clear answers, you could leave money on the table or face financial surprises. Imagine how easy selling your home would be with a straightforward understanding of realtor fees.

That’s precisely why we’ve created this comprehensive guide to demystify realtor commissions in BC. We’ll break down everything you need to know, from the basic definition of realtor fees to how they’re calculated, and even touch on specifics for the Vancouver market and RE/MAX agents. But the best part? We’re introducing our handy BC Realtor Fee Calculator! This powerful tool will allow you to quickly and easily estimate your commission costs, giving you the clarity and control you deserve. With this calculator, you can confidently plan your budget and make informed decisions every step of the way. No more guessing or surprises – just clear, concise information at your fingertips. Let’s dive in and take the mystery out of real estate commission!

Simply put, the realtor commission is the fee paid to real estate agents for their services in facilitating a property transaction. The commission is typically a percentage of the property’s sale price in real estate. Think of it as the cost of doing business when buying or selling a home. It’s the compensation realtors receive for guiding you through the complex process, from listing your property to negotiating offers and closing the deal.

While it might seem like a straightforward concept, there are some nuances. In BC, it’s customary for the seller to pay the commission, which is then split between the seller’s agent (also known as the listing agent) and the buyer’s agent. This means that even though both agents are involved in the transaction, the funds come from the sale proceeds. Here’s an important takeaway: as a seller, you’re responsible for both ends of the commission. It’s a crucial detail to remember as you navigate the selling process!

Because real estate is a competitive industry, there’s no set “standard” commission rate. While some real estate associations used to set fixed rates, competition laws now prohibit this. In BC, commission rates are negotiable and can vary depending on several factors, including the property’s location, the services the agent offers, and the overall market conditions. As a general guideline, you might see commission structures ranging from around 3% to 4% on the first portion of the sale price (for example, the first $100,000) and then a lower percentage (from 1% to 2%) on the remaining balance.

However, these are just examples, and the specific rate is something you’ll discuss and agree upon with your realtor. Don’t hesitate to ask your realtor about their commission structure and how it applies to your situation.

Addressing some common questions:

Understanding how real estate commission is calculated in BC is key to planning your finances when selling your home. While the specifics can vary, the general principle remains the same: it’s a percentage of the final sale price. Let’s break down the typical commission structure and how it works.

In British Columbia, the seller traditionally pays the commission, which is split between the seller’s agent (listing agent) and the buyer’s agent. This means that the sale price of your property determines the total commission, which is split between the two agents who facilitated the transaction.

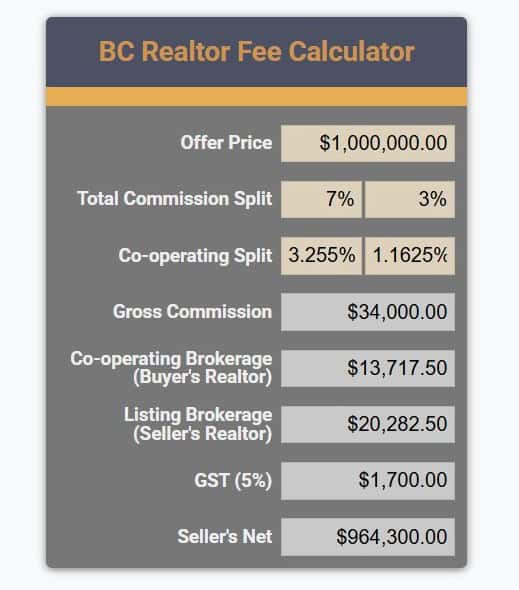

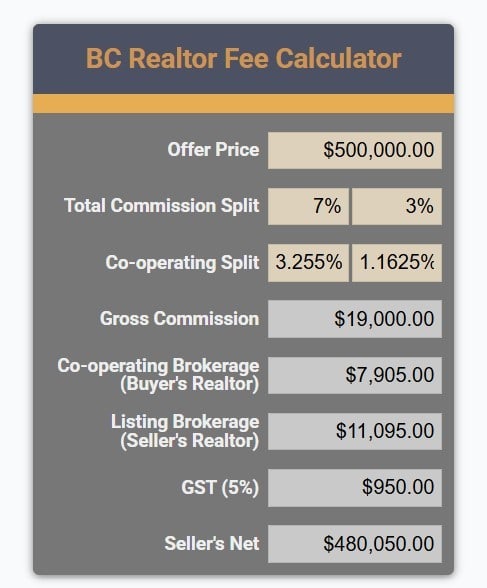

Here’s an example of how commission might be calculated using the rates I typically charge: I charge a realtor fee of 7% on the first $100,000 of the sale price and 3% on the remaining balance. To ensure a competitive offer for buyer realtors to show your property, I offer the buyer’s agent 3.255% on the first $100,000 and 1.1625% on the remaining balance.

Let’s illustrate with a $1,000,000 property:

Total Realtor Commission:

Buyer Agent Commission:

Seller Agent Commission:

In this example, the total commission is $34,000, split approximately 60/40 between the listing agent (myself) and the buyer’s agent. It’s important to note that the buyer agent’s portion is paid from the total commission, not in addition. Sellers sometimes mistakenly believe they pay both commissions separately.

It’s also crucial to remember that commission rates are negotiable. While the example above reflects my standard rates, other realtors and brokerages may have different structures. The best approach is to openly discuss with your chosen realtor their fees and how they calculate their commission. Don’t hesitate to ask questions and clarify any points you’re unsure about. Transparency is key to a smooth and successful real estate transaction.

Let’s tackle these common questions about real estate commission:

This section provides a summary of estimated real estate commission in Vancouver based on a range of sale prices, including the applicable GST. Based on the October 2025 benchmark price for all residential properties of $1,132,500, here is an example of the estimated commission breakdown a seller might pay:

| Sale Price | Total Commission | Seller’s Realtor Commission | Buyer’s Realtor Commission | GST | Seller’s Net |

|---|---|---|---|---|---|

| $718,900.00 | $25,567.00 | $15,117.29 | $10,449.71 | $1,278.35 | $692,054.65 |

| $720,000.00 | $25,600.00 | $15,137.50 | $10,462.50 | $1,280.00 | $693,120.00 |

| $1,066,700.00 | $36,001.00 | $21,508.11 | $14,492.89 | $1,800.05 | $1,028,898.95 |

| $1,070,000.00 | $36,100.00 | $21,568.75 | $14,531.25 | $1,805.00 | $1,032,095.00 |

| $1,132,500.00 | $37,975.00 | $22,717.19 | $15,257.81 | $1,898.75 | $1,092,626.25 |

| $1,133,000.00 | $37,990.00 | $22,726.38 | $15,263.63 | $1,899.50 | $1,093,110.50 |

| $1,916,400.00 | $61,492.00 | $37,121.35 | $24,370.65 | $3,074.60 | $1,851,833.40 |

| $1,920,000.00 | $61,600.00 | $37,187.50 | $24,412.50 | $3,080.00 | $1,855,320.00 |

| $2,000,000.00 | $64,000.00 | $38,657.50 | $25,342.50 | $3,200.00 | $1,932,800.00 |

| $3,000,000.00 | $94,000.00 | $57,032.50 | $36,967.50 | $4,700.00 | $2,901,300.00 |

| $4,000,000.00 | $124,000.00 | $75,407.50 | $48,592.50 | $6,200.00 | $3,869,800.00 |

| $5,000,000.00 | $154,000.00 | $93,782.50 | $60,217.50 | $7,700.00 | $4,838,300.00 |

| $8,000,000.00 | $244,000.00 | $148,907.50 | $95,092.50 | $12,200.00 | $7,743,800.00 |

| $10,000,000.00 | $304,000.00 | $185,657.50 | $118,342.50 | $15,200.00 | $9,680,800.00 |

Vancouver’s real estate market is unique, dynamic, and often highly competitive. While the general principles of realtor commission apply across BC, there are some nuances to consider when buying or selling in Vancouver. Due to the higher property values and specific market conditions, understanding commission structures in this area is particularly important.

Like the rest of the province, realtor commissions in Vancouver are not fixed by law. They are negotiable between the seller and the real estate agent. However, trends and typical ranges may emerge due to the Vancouver market’s competitive nature. It’s not uncommon to see commission structures similar to those elsewhere in BC, often involving a percentage of the sale price split between the listing and buyer’s agents.

Here’s what you should know about Vancouver real estate commissions:

Addressing some common questions about Vancouver realtor commissions:

In summary, navigating the Vancouver real estate market requires a thorough understanding of commission structures. Don’t hesitate to ask questions, negotiate rates, and compare services before selecting a realtor. A well-informed decision will help you achieve your real estate goals in this competitive market.

RE/MAX is a well-known real estate franchise with a significant presence in British Columbia. If you’re considering working with a RE/MAX agent, understanding their commission structure is essential. It’s important to remember that RE/MAX is a franchise, meaning individual offices are independently owned and operated. Therefore, while there might be some general similarities, commission rates are not standardized across all RE/MAX agents.

Like other real estate professionals, RE/MAX agents typically work on commission. This commission is a percentage of the sale price paid by the seller. However, the specific percentage can vary. Each RE/MAX agent runs their own business and can set their rates.

Here’s what you should know about RE/MAX realtor commissions in BC:

Addressing common questions about RE/MAX realtor commissions:

In short, when working with a RE/MAX agent in BC, don’t hesitate to ask about their commission structure upfront. Be prepared to discuss your needs and expectations, and remember that negotiation is often possible. Just because an agent works for RE/MAX doesn’t mean their commission rate differs from other realtors’. It’s all about the individual agent and your agreement with them.

While understanding how realtor commission works is essential, knowing how to negotiate it effectively is equally important. Remember, commission rates are negotiable, and it’s within your right as a seller to discuss this aspect of the transaction with potential realtors. Here are some valuable tips to help you navigate commission negotiations successfully:

By following these tips, you’ll be well-equipped to confidently navigate commission negotiations and achieve the best possible outcome when selling your home. The goal is to reach a mutually beneficial agreement for both parties.

Selling your home is a significant financial decision, and understanding the realtor commission in BC is a crucial part of the process. We’ve covered much ground in this guide, from defining realtor fees and how they’re calculated to providing tips for negotiating commission and introducing our handy Realtor Fee Calculator. The key takeaway is that knowledge is power. By understanding the intricacies of realtor commissions, you can make informed decisions that align with your financial goals and ensure a smooth and successful selling experience.

Let’s recap the key points:

By now, you should have a much clearer understanding of real estate commissions in BC. You know what it is, how it’s calculated, and how to discuss it with realtors. You also have a valuable tool – the Realtor Commission Calculator – to help you make informed financial decisions. Remember, transparency is key. Don’t hesitate to ask realtors about their commission structures, compare their services, and negotiate a rate that works for you.

Ultimately, the goal is to sell your home for the best possible price while also being comfortable with the commission you pay. With the information in this guide and the help of our calculator, you’re well on your way to making informed decisions and achieving your real estate objectives.

Ready to take the next step in selling your home? Understanding realtor commission is just the beginning. To truly maximize your return and navigate the complexities of the BC real estate market, you need a trusted and experienced real estate professional by your side.

I’m Sam Huang, a seasoned real estate agent with over 15 years of experience helping homeowners in Vancouver and across BC achieve their real estate goals. I’m committed to providing personalized service, expert guidance, and proven results. Whether you’re just starting to explore your options or are ready to list your property, I’m here to help.

Here’s how you can connect with me:

I understand that selling your home is a big decision, and I’m here to make the process as smooth and stress-free as possible. From market analysis and pricing strategies to negotiation and closing, I’ll be your dedicated advocate every step of the way. Don’t leave money on the table – contact me today, and let’s discuss how I can help you achieve your real estate objectives. I look forward to hearing from you!

We understand that you still have some questions about realtor commissions in BC. This FAQ section addresses some of the most common inquiries we receive. If you don’t find your answer here, please don’t hesitate to contact us directly—we’re happy to help!

Realtors representing sellers and buyers usually get paid when the transaction is complete. Typically, it is the completion date. On the completion date, the title is transferred to the buyer, and the seller receives the money from the sale. The buyer’s realtor is typically paid sooner than the seller’s agent because the buyer’s brokerage typically deducts the buyer’s portion of the commission from the purchase deposit, then transfers the remaining balance to the buyer’s lawyer before the completion date.

After the completion date, the buyer’s lawyer will write a commission cheque to the seller’s brokerage. After the seller’s brokerage receives the cheque, it deducts office fees and then deposits the commission directly into the seller’s realtor account.

In British Columbia, it’s common for the seller to cover the realtor fees, which are shared between the seller’s realtor and the buyer’s realtor. Generally, buyers don’t pay these commissions directly. However, there are instances where buyers DO pay realtor fees themselves.

I’ve had the pleasure of working with a developer client who is on the lookout for a piece of land in the vibrant South Burnaby area, specifically one with duplex zoning. This project took place before the recent changes to zoning rules introduced by the BC government in November 2023. Before these changes, finding duplex-zoned properties was quite a challenge due to their high demand; they would often sell immediately upon listing.

My client came to me with a specific goal: to discover duplex-zoned properties not yet on the MLS. He was open to paying the buyer’s commission if I could identify a suitable off-market option. I successfully found a property where the owner is willing to sell outside of the MLS!

To sum it up, while most buyers don’t have to worry about realtor fees when purchasing a home, there are situations where buyers are eager to pay for realtors’ expertise to uncover hidden gems in the market.

One thing many sellers might not realize is that, in addition to the commission, there’s a 5% Goods and Services Tax (GST) on that commission amount. Prior to July 1, 2010, there were separate taxes in place, but the BC government introduced the Harmonized Sales Tax (HST) of 12%, uniting GST and PST. While the HST was initially met with resistance and later removed following a 2011 referendum, it streamlined the tax process. As of April 1, 2013, BC reverted to the previous system, and now homeowners only need to pay the 5% GST on real estate commissions.

Here is a summary of the essential services your legal professional provides:

| Category | Key Services Provided |

|---|---|

| Document Review | Reviewing the final, signed Contract of Purchase and Sale provided by you or your realtor. |

| Title Management | Conducting a title search to identify any mortgages, liens, or claims (charges) against the property. They confirm with you which charges you are responsible for paying. |

| Mortgage Discharge | Requesting and reviewing payout statements from your current lenders. They ensure your lenders receive the necessary funds and that discharge forms are completed after closing to remove the mortgage from the title. |

| Transaction Prep | Receiving, reviewing, and making necessary revisions to the sale documents sent by the Buyer’s legal representative. They prepare all your supporting documents for signing. |

| Closing Execution | Arranging for you to sign all the sale documents and supporting papers. They negotiate the final closing undertakings (agreements) with the buyer’s lawyer/notary. |

| Funds & Final Steps | Receiving and managing the sale proceeds in their trust account. They disburse these funds, pay off your mortgage, pay your commission, and send the remaining net proceeds to you. Finally, they issue a formal closing report. |

On the completion date, your lawyer also handles disbursements. These are third-party costs that are paid through your lawyer, and they include fees such as: Land Title Office fee (to register the discharge of your mortgage), Trust administration fees, and Transaction insurance fees (if applicable).

Sam Huang PREC

H & S Real Estate Group

Real Estate Coal Harbour

RE/MAX Select Properties

Address: 5487 West Boulevard, Vancouver BC V6M 3W5, Canada

Phone: 778-991-0649

WeChat: ubchomes

QQ: 2870029106

Email: Contact Me